Stamp Duty changes 2025

Changes to Stamp Duty Land Tax (SDLT or Stamp Duty) are being introduced from 1st April 2025.

Our team will be happy answer any questions you may have about the new amounts and how this affects your property purchase. This will impact everyone planning to move, not just first-time buyers.

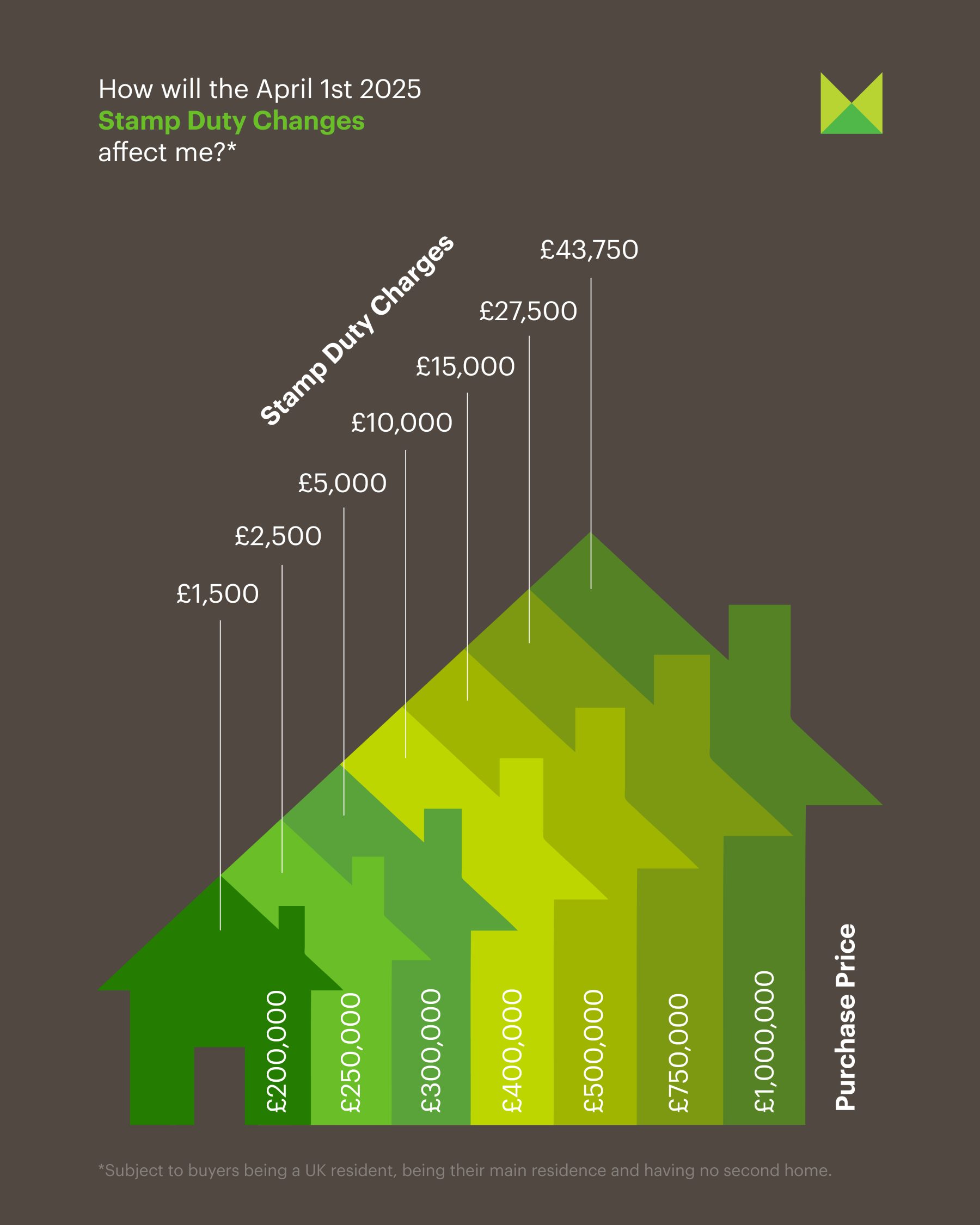

On all property purchases completed after 31st March 2025, the temporary thresholds on Stamp Duty implemented in September 2022 will come to an end. These are the key changes:

- For all movers, the current zero rate threshold is lowering from £250,000 to £125,000.

- All purchases up to £125,000 will continue to pay 0% SDLT.

- Stamp Duty of 2% will be payable on purchases between £125,001 to £250,000. Buyers will pay up to £2,500 more.

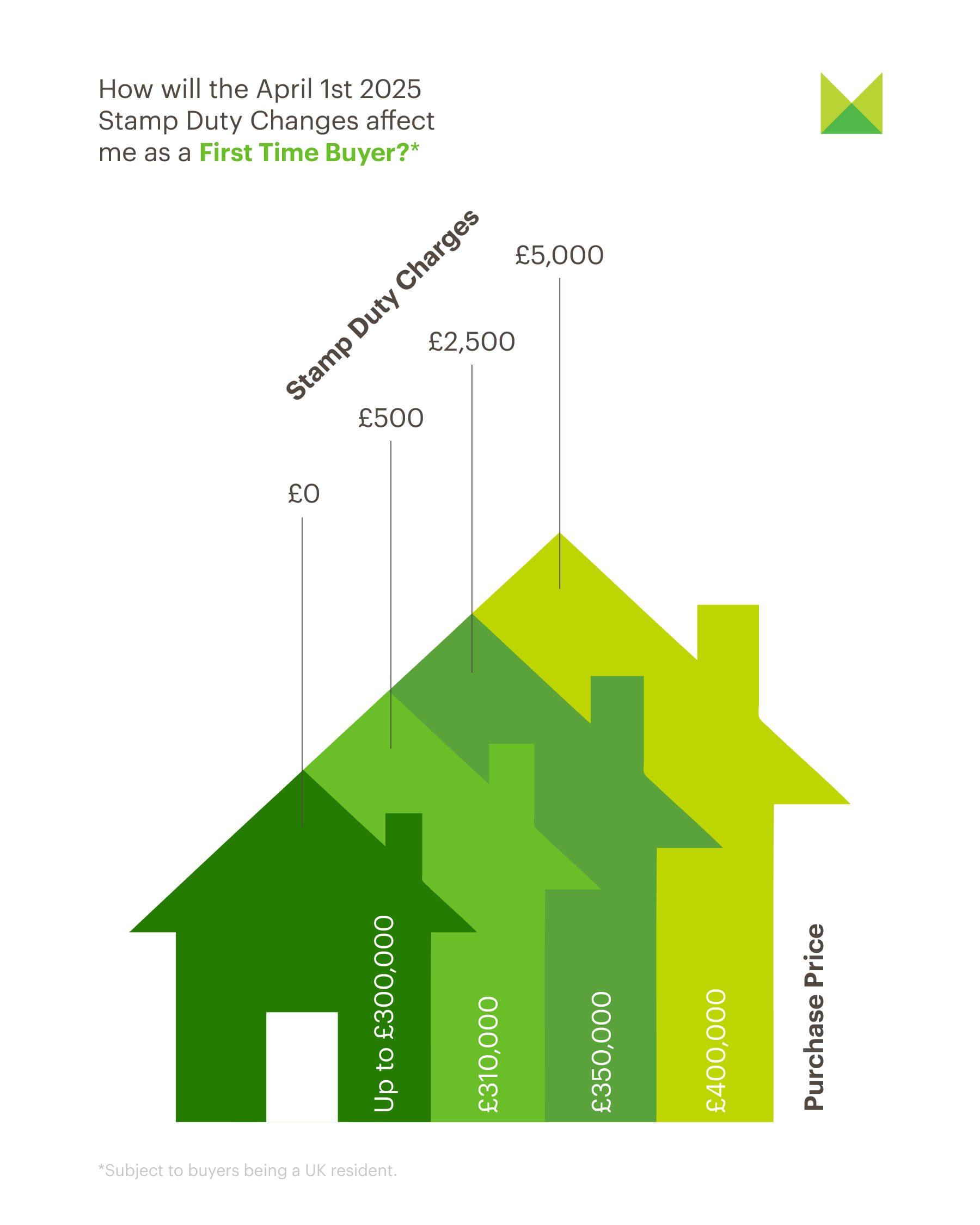

- For First Time Buyers, the current zero rate threshold is lowering from £425,000 to £300,000.

- All First purchases up to £300,000 will continue to pay 0% SDLT.

- Stamp Duty of 5% will be payable on First Time purchases between £300,001 to £500,000. First Time Buyers will pay 5p more for every £1 over £300,000, up to £500,000. For example, a property of £350,000 will pay £2,500 in SDLT.

- The maximum purchase price on which First-Time Buyers can claim relief is lowering from £625,000 to the previous level of £500,000.

- For Second Home Buyers, a new rate of 7% will be introduced on properties between £125,001 to £250,000. Second Home buyers will pay up to £8,750 more.

Can I avoid Stamp Duty increases in 2025?

Property purchases must be completed before 1st April 2025 to avoid these changes. With a timescale of 12-16 weeks for conveyancing, we advise all clients who have not yet agreed a sale to budget for the increased amounts.

What is not changing?

At the upper end of the Stamp Duty table, on properties above £250,000, there are no changes to the SDLT rates:

- £250,001 to £925,000, the rate remains at 5% (10% for Second Homes)

- £925,001 to £1.5 million, the rate remains at 10% (15% for Second Homes)

- Over £1.5 million, the rate remains at 12% (17% for Second Homes).

Please speak to our agents about the new amounts and how this affects your property purchase.

Read next: New homes – Selling your home – What makes us, us?

Always wanted to build

your dream home?

Why not buy off-plan.

If you like the idea of working with the developer and creating something unique for you then your journey begins with completing this form: